Maximizing your profits while minimizing your tax liabilities is not just a goal; it's a necessity for sustainable growth.

John Doe

CEO, Digital Wealth Solutions

Tax Reduction and Wealth Growth Solutions for Digital Entrepreneurs

We help digital entrepreneurs and freelancers in Europe to optimize tax liabilities and build sustainable wealth

Substance

Most EU countries now use "Place of Effective Management" rules. Your residency country may still claim the right to tax the company´s entire income because the physical location of the "mind and management"

FATCA

The Automatic Exchange of Financial Information agreement crosses information between bank accounts and their beneficial owner

CFC Rules

Controlled Foreign Corporation (CFC) laws often require individuals to report and pay tax on the profits of their offshore companies even if they don't withdraw the money

Transparency

EU banks and payment platforms are required to automatically report account data to local tax authorities.

Unshell Directive (ATD 3)

Ensure foreign setup meets the minimum "substance" requirements to avoid being flagged as a shell company by local authorities

Wealth Tax Thresholds

Some countries may still apply taxes to the global assets held in the offshore entity if an individual net worth exceeds certain limits.

The game is changing and is not more about hiding money but about structuring it properly so you stay fully compliant while as tax-efficient as the law allows

Defined Framework that meets your personal situation while remaining fully compliant

Launch

Defined Framework Setup with Ongoing Support and quarterly tax forecast

Growth

Defined Framework Setup, Ongoing Support with quarterly tax forecast and Advanced Audit Protection

Scale

Tailored advice through personalized one-on-one consultations.

Personalized Consultation

Custom Solutions

Choose from our distinct service tiers designed to optimize tax compliance and enhance your profitability.

Structured Tax Solutions

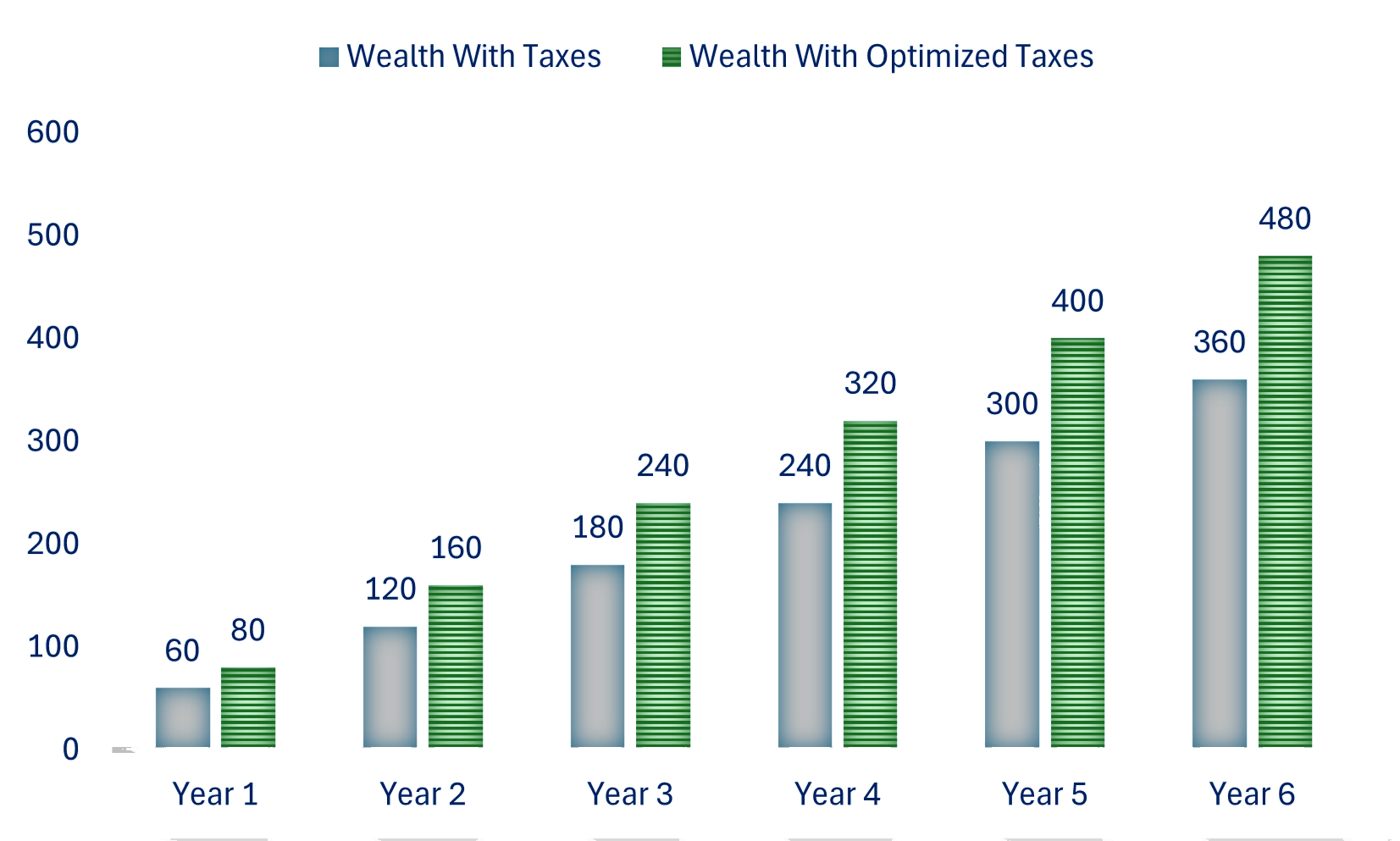

Our frameworks help digital entrepreneurs legally minimize tax liabilities while maintaining compliance with European regulations.

Continuous Monitoring

The framework you have in place today will most like pass the test of time but as regulations change and your life evolves, new requirements need to be meet.

Transparent Service Levels

Choose from four clearly defined service tiers designed to optimize your tax position and support sustainable financial growth.

Long-Term Wealth Focus

We emphasize strategies that protect your assets and promote steady wealth accumulation aligned with your business goals.

You want to move forward

Complete the Tax & Wealth Assessment and once we review it we will get in touch. If you need more book a 1:1 consultation

Not quite sure... keep up to date

We get it, we also took sometime to give the first step. Subscribe our monthly newsletter and stay up to date.

The Death of the Paper Company: Navigating EU Substance in 2026

The era of the “shell company” is officially over across the European Union. With the full implementation of ATAD 3 and evolving CFC (Controlled Foreign Corporation) rules, tax authorities from Berlin to Rome are now using AI-driven tools to flag entities that lack “economic substance”.

Beyond Territorial Tax: Why EU Freelancers Use “The Triangle”

While some European countries offer territorial tax benefits, high-earners are increasingly adopting the Triangular Structure—a local EU entity for domestic life and a US LLC for global scaling. This setup allows for legal tax deferral on global profits while maintaining a fully transparent local presence for domestic expenses.

DAC8 is Here: The End of Offshore Secrecy for EU Residents

As of January 2026, the DAC8 Directive has expanded the automatic exchange of information to include crypto-assets and tighter reporting on foreign bank accounts. The “invisibility” of a US bank account is a myth of the past. The goal for 2026 is not about hiding money, but about legal efficiency

US LLC vs. Estonia

e-Residency:

The 2026 Tax Showdown

For years, Estonia’s 20% deferred corporate tax was the “go-to” for EU nomads. However, the US LLC is emerging as a more powerful vehicle for those seeking 0% federal tax on “Non-US Sourced Income”. When paired with an EU residency, the US LLC can offer superior flexibility for profit reinvestment. W

The Death of the Paper Company: Navigating EU Substance in 2026

The era of the “shell company” is officially over across the European Union. With the full implementation of ATAD 3 and evolving CFC (Controlled Foreign Corporation) rules, tax authorities from Berlin to Rome are now using AI-driven tools to flag entities that lack “economic substance”.